Gratitude's the attitude

How to frame your year together around what's gone right.

While you read this week’s newsletter, I am probably fighting for a parking spot at our neighborhood Trader Joe’s to secure The One Missing Item™ from my grocery list. Honestly, I wouldn’t have it any other way. We’ve hosted the lion’s share of Thanksgivings since moving into our home nine years ago. It’s one of the things we love to do most.

Now, I’m not saying I am a pleasure to be around in the days leading up to the big meal. If Doug crosses my path during food prep or fails to follow my explicit instructions as front of house, he will meet the same fate as Gordon Ramsay’s disgraced pupils. But hey, at least we’re only at each other’s throats over the oven temperature. For so many couples and families, the holidays can conjure up a whole lot of conflict, which I think, we’ll save for December. For now, just know that we know how easy it is to slip into stressing and screaming as the default mode of communication in overstimulating times like these.

But it doesn’t have to be this way. You can choose to see the forest for the trees.

Since we began promoting Money Together, many have asked us for tangible tips on improving the ways you talk to your partner about money. One of our favorites is simple: framing. When you begin your conversations around what has gone well, you open the door to more constructive opportunities to address what needs to improve.

Thanksgiving is the perfect time to start.

Try having an end-of-year conversation framed in gratitude. You aren’t glossing over reality by welcoming in the broader perspective that you’ve done a lot of meaningful work together this year. I bet many of you will find you’ve done more good than bad, things are better than they seem, and much of what you value most, you already have.

I know. You’re thinking, Heather, you sound like you’ve just come off a Hallmark movie bender. But just trust me. Pour yourselves a glass of wine or tea and give one (or all) of these prompts a shot:

What did we do well together this year?

Celebrate your wins, big and small. Maybe you automated savings or taught your tween some important lessons about money and responsibility. Maybe you just toughed it out through a tough work season where income felt unstable. But you did it. Recognize it.

Where did we grow as a team?

Growth is uncomfortable and messy. But we keep trying, because it’s worth it. Look at the ways you adapted, compromised, and deepened your understanding of each other. If you read our book or took the time to start talking through some of its questions, you’re already one step further than you were before you did.

What can we appreciate about how the other person showed up?

This is the moment to acknowledge all the physical, emotional, and mental labor your partner put in to provide for you and your family this year. How did their contribution support you? Name it. You can sort out whatever needs to change soon, but this moment is just to acknowledge the role each of you has played in helping the other person. Appreciation plays such an important role in tempering resentment.

What do we want to protect going into next year?

Think about your priorities, your values, and your dearest relationships. These are the things to safeguard as you head into a new season. By identifying them—especially now—you can remember what’s most important. Even if you burned the cornbread.

As we begin to reflect on our own year, we want you to know how grateful we are for you. Thank you for reading and subscribing to The Joint Account. Thank you for embracing Money Together and taking the time to share, screenshot, email, and call us with your thoughts. Thank you for leaving us reviews (cough, cough), thank you for telling your friends, and thank you for opening doors for us. We want our work to be purposeful and come to life in your homes, and every day, with every email sign-up to receive our questions on the go, we know this is happening.

These feelings are the perspective we carry, even when things don’t go exactly as planned. We know that this is the start of a season that feels full: our book, our family, our friends, our chances to impact people’s lives while supporting our own.

We have plenty.

Well, did you try the questions? Let us know what you’re thankful for.

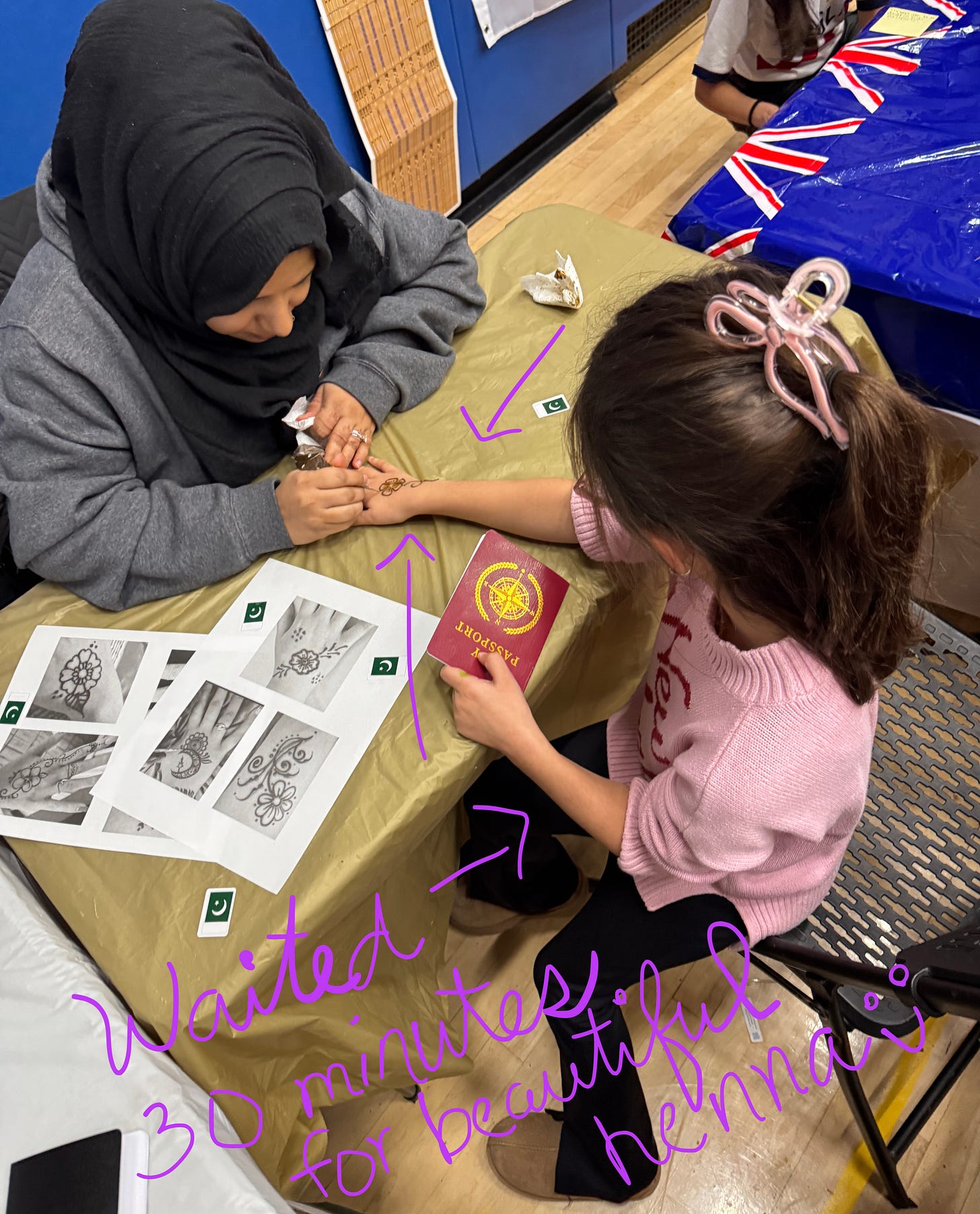

We’ve spent a ton of time with the girls in November (some fellow New Jersians may know this as “No School November”). Aside from the lack of school, we’ve also had a lot going, like our favorite event of the year: Multicultural Night. This is truly the greatest event, with families showing up to represent nationalities from all over the world with excellent food, activities, outfits, and pride. Did I mention the food? I’m not talking cookies. Everyone goes all out with stew, dumplings, samosas—I’m pretty sure Hazel tried jerk chicken. Anyway, it felt very fitting to enter the holiday season with a reminder to embrace what makes us different and recognize that despite those differences, we can all belong.

The life of a showgirl (and boy)

We had another jam-packed week. First, we sat for a meaningful Zoom double-date with Jess and Brandon of The Sugar Daddy Podcast. Douglas hosted a virtual book event for clients of Wealthbox, a CRM software company for financial advisors. We went live with Jay Coulter for his Resilient Advisor podcast (but you can check out the recording here). And in what was my favorite book-related appearance outside of our day at 30 Rock, we guest lectured for Professor Megan McCoy’s Relationships and Money course at Kansas State University!

Where should we visit next??? Let us know!

Money Together is here! Order now in your format of choice.

Love it already? Leave us a review on Goodreads and wherever you purchased!

Want more Heather and Doug? Have us come talk love and money for your organization, virtually or IRL. Reach us here.

Connect with us on social: @averagejoelle + @dougboneparth

The content shared in The Joint Account does not constitute financial, legal, or any other professional advice. Readers should consult with their respective professionals for specific advice tailored to their situation. The information contained in this post is general in nature and for informational purposes only. It should not be considered as investment advice or as a recommendation of any particular strategy or investment product. This post is not a solicitation or an offer to buy or sell any specific security. Bone Fide Wealth cannot guarantee the accuracy of information from third parties.