A note on thanks

And the only shopping list you'll need this week.

Hi, friends. Heather here, reporting to you live from my attempt to squeeze a full work week into two business days. I know, I know, me and everyone else.

I’m sorry if you’ve felt abandoned by the female voice of this newsletter, but I’ve been engrossed in drafting our forthcoming book, Money Together. That’s right, our book has a title, and more than 55,000 words behind that title already. It’s kind of hard to believe. When you work on a big project for a long time, you tend to see the little trees you’re planting and not the forest it creates. But here I am, deep in the woods.

I am finding this moment exciting, overwhelming, isolating, and tiring. All the things. You don’t need to be a writer to relate to these feelings. When you pour your whole self into something—closing a deal, running a marathon, even raising kids—your expectations grow with the time and commitment you’ve put in. You can quite literally feel the stakes rising, which is not to say this is a healthy response, but I think it’s a pattern we tend to fall into.

We’ll be sharing much more about the book and the process of creating it in 2025. But today, I brought up my feelings around my current moment for a reason: it’s very easy to get lost in a forest of your own expectations. When you do, you risk losing perspective on not only how far you’ve come but all the great stuff you already have.

Honestly, I worry a lot about lost opportunities. When I see another writer forming a connection I wish I had, or growing their newsletter faster, or snagging a dream endorsement, I really harp on these things. Then, I shame myself for not working harder to get them sooner. Then, I project that frustration on Doug and my kids. Of course, this is the wrong thing to do. The right thing is to stop treating what I haven’t done yet as a failure, and instead, treat doing those things when I can as an opportunity. But you know, easier said than done.

Thanksgiving tends to check my perspective. Every single piece of what I dreamed about is here: a supportive relationship; beautiful children; financial resources; and a career that is so honest to who I am. I get to write to improve people’s relationships with money. I get to live with the purpose I sought for so long.

The intangible from a decade ago is real right now. It can be hard to see that sometimes, but maybe this week, you should just try.

Thank you to the entire Joint Account community for growing with us this year. I’m so grateful for what we’ve done and what we’re going to do together.

Now, onto our next order of business. We can’t publish a money newsletter Thanksgiving week without acknowledging the kick-off to the busiest spending season of the year. Black Friday is upon us, and if my inbox and feed have anything to say about it, the frenzy has already begun.

I’ve reflected on my spending behaviors as a consumer many times before. So, this feels like the perfect time to compile those links for you, in case you’re looking to examine your own patterns this time around (and have a laugh while you’re at it).

In Steal, Staple, Splurge, I shared a shopping strategy for not blowing your budget on hot-to-go trends while investing in quality pieces for the long-term.

I cleaned out the junkyard in our basement and learned an important lesson about the fleeting nature of crappy children’s toys.

From the beaches of an island vacation, I pondered who benefits when we expose our kids to luxury—them or us?

A decade later, Douglas and I poked fun at the seriousness of our wedding registry, underscoring how much our priorities can change.

AND

I walked you through the suspense of scarcity marketing tactics and what makes some of us (ahem, me) so susceptible.

Happy reading, happy shopping, and Happy Thanksgiving! Save some mashed potatoes and Ugg Tasman slippers for us!

Want to talk shop while digesting on the couch? Email us.

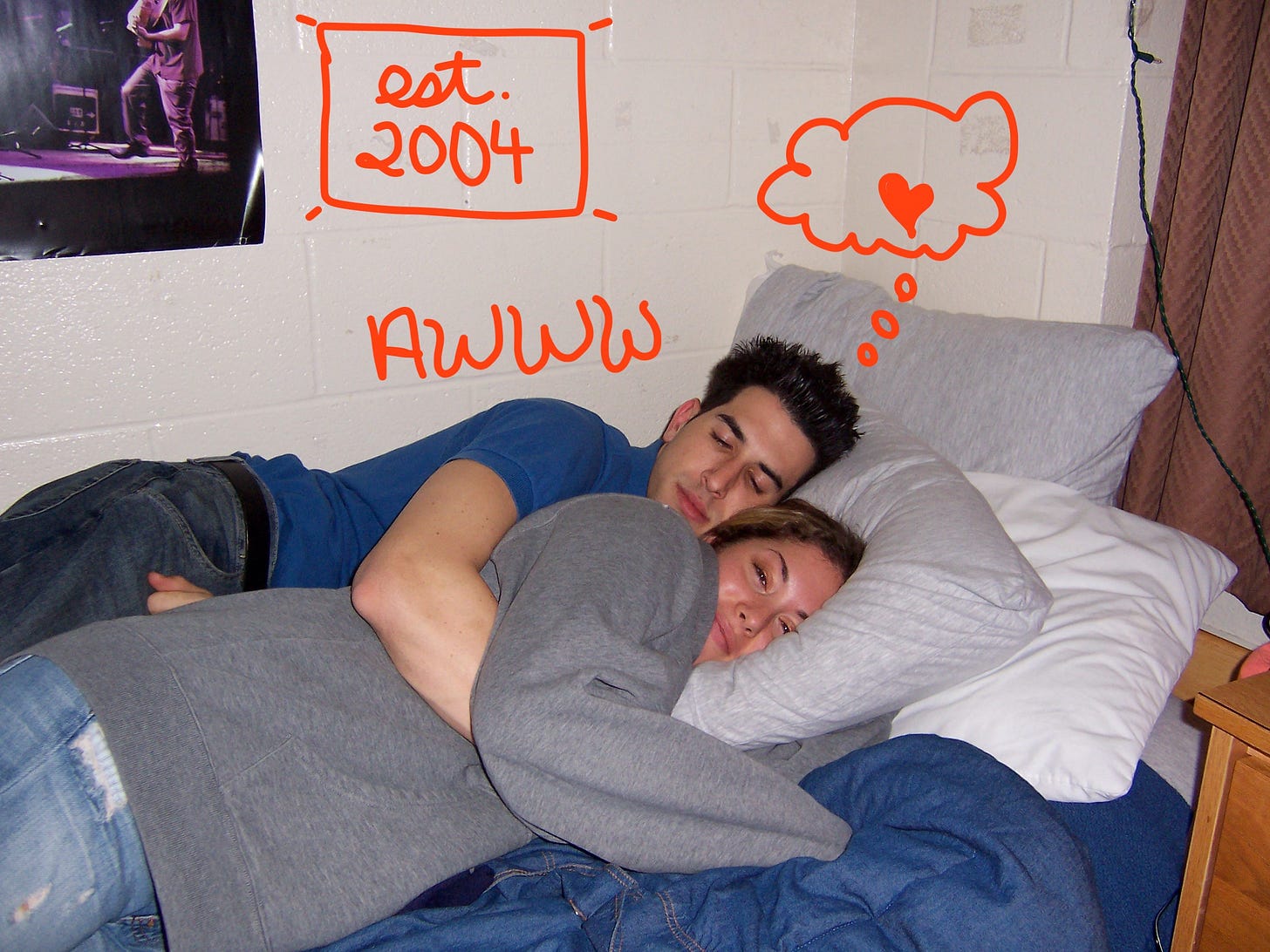

Above is one of the earliest recorded images of Doug and Heather, circa 2004, taken in Jennings Hall at The University of Florida. Peep the bottom half of Dave Matthews in the poster above my bed! I share this relic from the past in honor of us both joining BlueSky, the hot new X-coded social media platform. It’s kind of nice and awkward right now and reminds me of the early days on other social sites, like when I first gained access to Facebook and uploaded this and 7,000 other photos to an album thinking no one outside of the 20 friends I had would ever seen them. What a time to be alive.

Anyway, you can follow us there: @averagejoelle + @dougboneparth.

TJA in the news!

For CNBC, Doug echoed what Warren Buffett had to say about parents letting children in on their estate plans.

He also spoke with CBS about the ways to tackle your credit card debt before the holidays.

Reader roll call!

Do you have a love and money question for Douglas to answer in a future issue of The Joint Account? Don’t be shy. Let us know.

Are you a brand or business interested in reaching The Joint Account’s 13K+ subscribers?

Would your organization benefit from having us talk about love and money?

We’d love to hear from you!

Find us on social: @dougboneparth + @averagejoelle.

The content shared in The Joint Account does not constitute financial, legal, or any other professional advice. Readers should consult with their respective professionals for specific advice tailored to their situation.

Will you leave Substack for blue sky? Are you concerned about blue sky being exclusionary to other thoughts, experiences and different audiences that you are unaware of?