Set it and forget it

What you can automate to make your lives easier.

January is a good time for a factory reset. You already know I don’t believe in resolutions, but the new year still presents a chance for you to look at how things are working, how they’re not, and how you can do them a little better.

It may sound cliché to suggest you “work smarter, not harder,” but not if you’re not doing it. In the past, we’ve been guilty of unnecessarily reinventing the wheel. I’m not sure whether it’s because we wanted to maintain an undue level of control over something, or we were just too lazy to put the systems in place. Now, we rely on all sorts of systems, schedules, and automations to function.

We aren’t suggesting you can optimize your way to wealth and happiness through an 8-step guide or 12-pronged process. We literally just wrote a book about how you can only control what you can control. But when you can get certain predictable tasks to run in the background, life can feel easier. You can have fewer check-ins that don’t add value, fewer minor decisions that drain your energy, and fewer chances for critical items to fall through the cracks.

Best of all, you can use the time you get back for other things that matters to you.

Over lunch last week, Douglas and I talked about what we’re setting and forgetting. We also uncovered a few more things we could do, and a few you could do, even though they don’t make sense for us right now:

Bill pay.

This is the obvious one. We schedule automatic payments for our most predictable bills: cars, home mortgage, utilities, memberships, insurance, office rent, and student loans. Notably, we don’t use autopay for our joint and individual credit cards, because we like to review them, decide where to pay them from, and make sure we don’t have any questions.

Retirement plan contributions

The next two depend on what you can afford. But if you work for a corporate employer, you can log into your portal at any time to set or change the percentage of your paycheck to allocate to your company’s retirement plan. If they offer an employee matching program, consider at least contributing up to the percentage of the match. We don’t love the term “free money,” but this is as close as you’ll get. Let your work do the work for you.

529 plan contributions

We’re honestly a bit conflicted over how much money to save for our girls’ college education (a story for another day), but regardless, we feel good about chipping away at it every month. Some 529 plans allow you to set your auto-contributions for as little as $25-$50 per month. Be mindful of potential state tax deductions available to you, as well.

Annual home maintenance

In the past, we dropped the ball on household upkeep when our lives got complicated, but by signing up for a few regular maintenance programs, we don’t have to worry about remembering to schedule things as the seasons change. They call us, or if it’s an outside-the-house job, they just do it. We have service contracts with: our pest control company, our landscaper, a gutter cleaner, and the company that installed our HVAC unit, which comes out to service the unit, change our filters, and clean our vents. They also clean our dryer vent, which apparently is a huge fire hazard if you don’t do it! Homeownership is really “learn as you go.” I’m just glad that over a decade, we figured some of it out.

Household items

We did this when the girls were younger, and then we stopped, but after getting down to our last roll one too many times, I’m ready to start up again. Using a few “subscribe and saves” on Amazon or your favorite online retailer for high-use household items will absolutely save you from a late-night fire drill. If you have a little one, subscribing for diapers, wipes, baby soap, formula, or their favorite food pouches might make sense. For the rest of us, at least paper goods, detergent, dish soap, and garbage bags—the basics. The only caveat here is to be conscious of your inventory. If you start collecting a surplus, you know it’s time to pause or spread out the order frequency.

Money dates

You know we love our quarterly money dates. Make the commitment and pre-schedule all four of them now. You both have a general sense of your most low-stress, low-distraction windows of time to lock them in for. And even if your schedules require you to move them, there’s still a greater likelihood that they will take place if you do it this way than if you wait until two weeks before the quarter ends and you’re scrambling.

Babysitters

Date nights are important to us. Sometimes, we book sitters even when we don’t have plans yet. If you have a sitter that your kids really love, consider asking them if they’d commit to one or two Saturday nights a month, or say, the first Saturday of every month. That predictability’s great not only for the kids, but for your relationship, too.

What did we miss? Do you have any preset tasks that make your lives way easier? Let us know.

The Sub Edit: Rocket Money

This year, we want to share more of our financial lives with you. The Sub Edit will be a recurring mini-series where we share the subscriptions we’ve added / deleted from our life stack (not Substack, that would just be rude), and why.

In the spirit of this week’s newsletter being about systems and automation, I’ll say that Rocket Money is a good app. I enjoyed trying it for one year. The spending tracking is clean, the interface is intuitive, and the subscription finder alone is worth the download. I found a couple zombie subscriptions I genuinely forgot about and cancelled them without much effort. But after a year, I realized I was paying for something that wasn’t providing me with enough information. It just verified what I was already doing on my own.

I already pull together our household expenses at a high level. I know where our money goes broadly, but what I want now are the details. For that, I need flexibility to decide how expenses are categorized—not just a default bucket that “sort of” fits a particular expense. I should be able to tweak, rename, split, and analyze spending in a way that reflects how our family finances work.

Rocket Money feels too general for us. Reporting is fine but not deep. We don’t use the investment features, and once I got past the initial “wow” moment of uncovering subscriptions, the app became just another monthly charge solving a problem I’d already solved. -Douglas

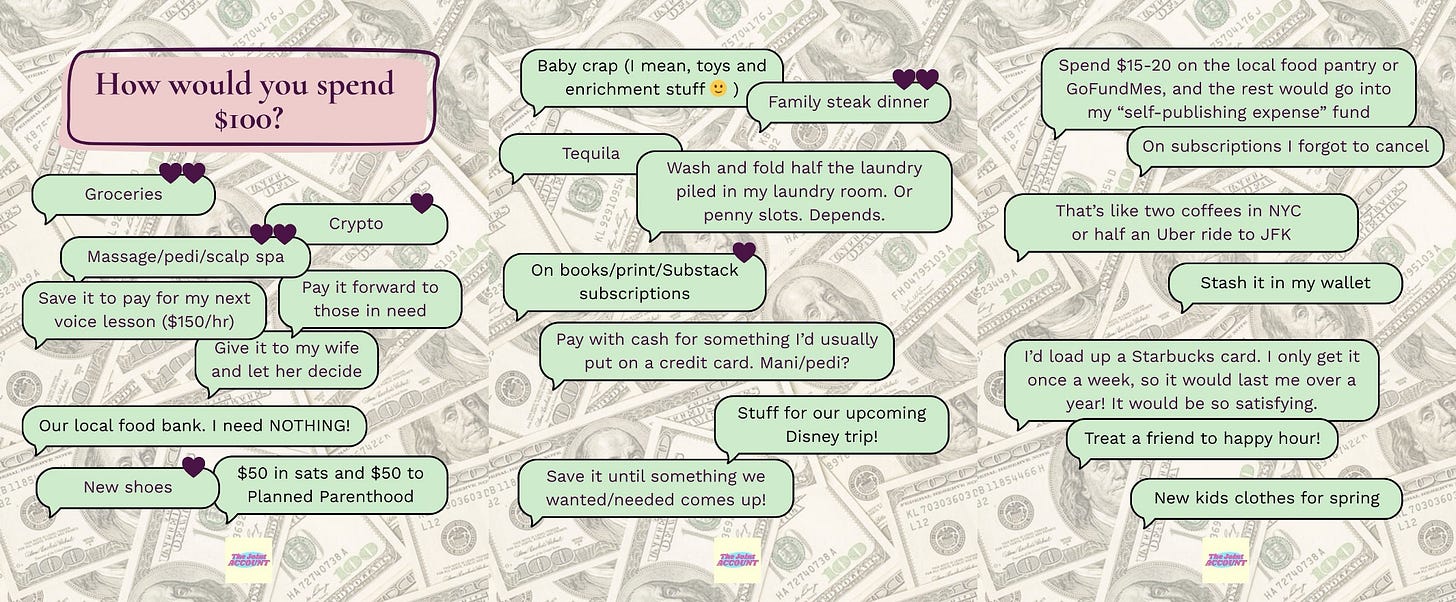

How Would You Spend (HWYS) $100?

This will be another new mini-series, born from an interview question we asked couples for Money Together. We want to know how you’d spend a set amount of money. This isn’t money in your paycheck—it’s money that comes by surprise. We’re starting with $100, and your responses are awesome. Oh, and for the future, don’t get cute and bring up taxes. The money is all yours!

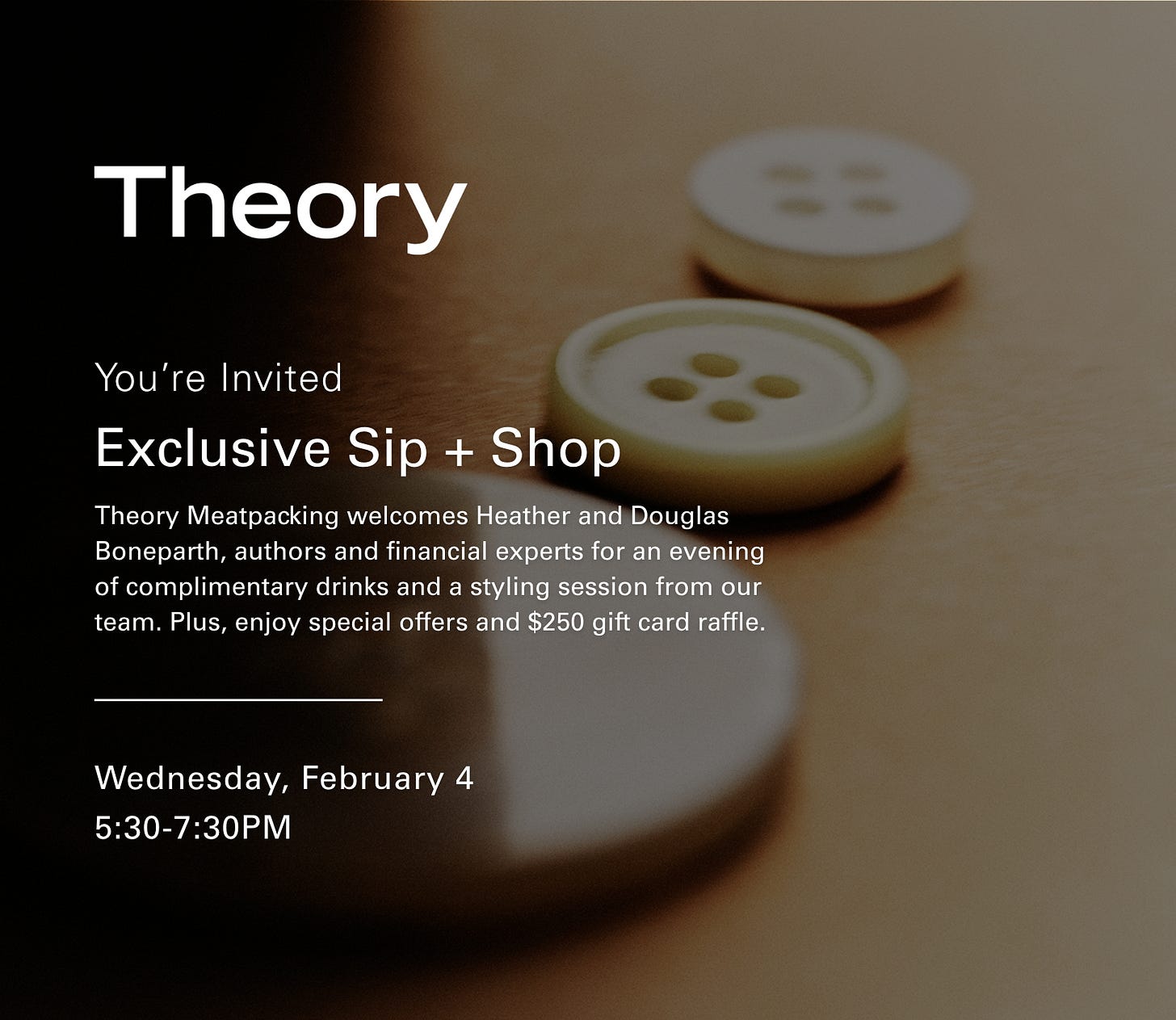

Join us in NYC on February 4th @ 5:30pm

What does it really mean to be a power couple? Join us at Theory - Meatpacking District for an evening all about partnership, ambition, personal style, and showing up as your best selves—together. Sip some bubbly, spend time with us, receive 20% off your in-store purchase, and enter to win a $250 gift card.

We hope to see you there - let us know you’re coming:

We’re in the news

New this week, we had the pleasure of joining two thoughtful conversations outside the traditional money space. We appeared on Dr. Alexandra Solomon’s Reimagining Love podcast and the Kids or Childfree podcast, where we explored how money intersects with family, relationships, and life choices. These conversations were powerful reminders that money is deeply personal and can impact our loved ones in countless ways.

Money Together is here! Order now in your format of choice.

Love it already? Leave us a review wherever you purchased!

Want more Heather and Doug? Have us come talk love and money for your organization—virtually or IRL. Reach us here.

Connect with us on social: @averagejoelle + @dougboneparth

The content shared in The Joint Account does not constitute financial, legal, or any other professional advice. Readers should consult with their respective professionals for specific advice tailored to their situation. The information contained in this post is general in nature and for informational purposes only. It should not be considered as investment advice or as a recommendation of any particular strategy or investment product. This post is not a solicitation or an offer to buy or sell any specific security. Bone Fide Wealth cannot guarantee the accuracy of information from third parties.

Love this! Like you have your HVAC people, one thing that I've heard people do and plan to implement if we ever buy a house again is schedule a home inspection every 3-5 years. It's a way to discover all the little things before they become big things and put plans in place to get them fixed 😊

I love the habit of automating a babysitter for date night -- prioritizing your relationship! Do you offer your babysitter bonuses for chores? If not, check this idea out I saw on Upworthy a while back: https://www.modernhusbands.com/post/the-best-babysitter-idea-ever