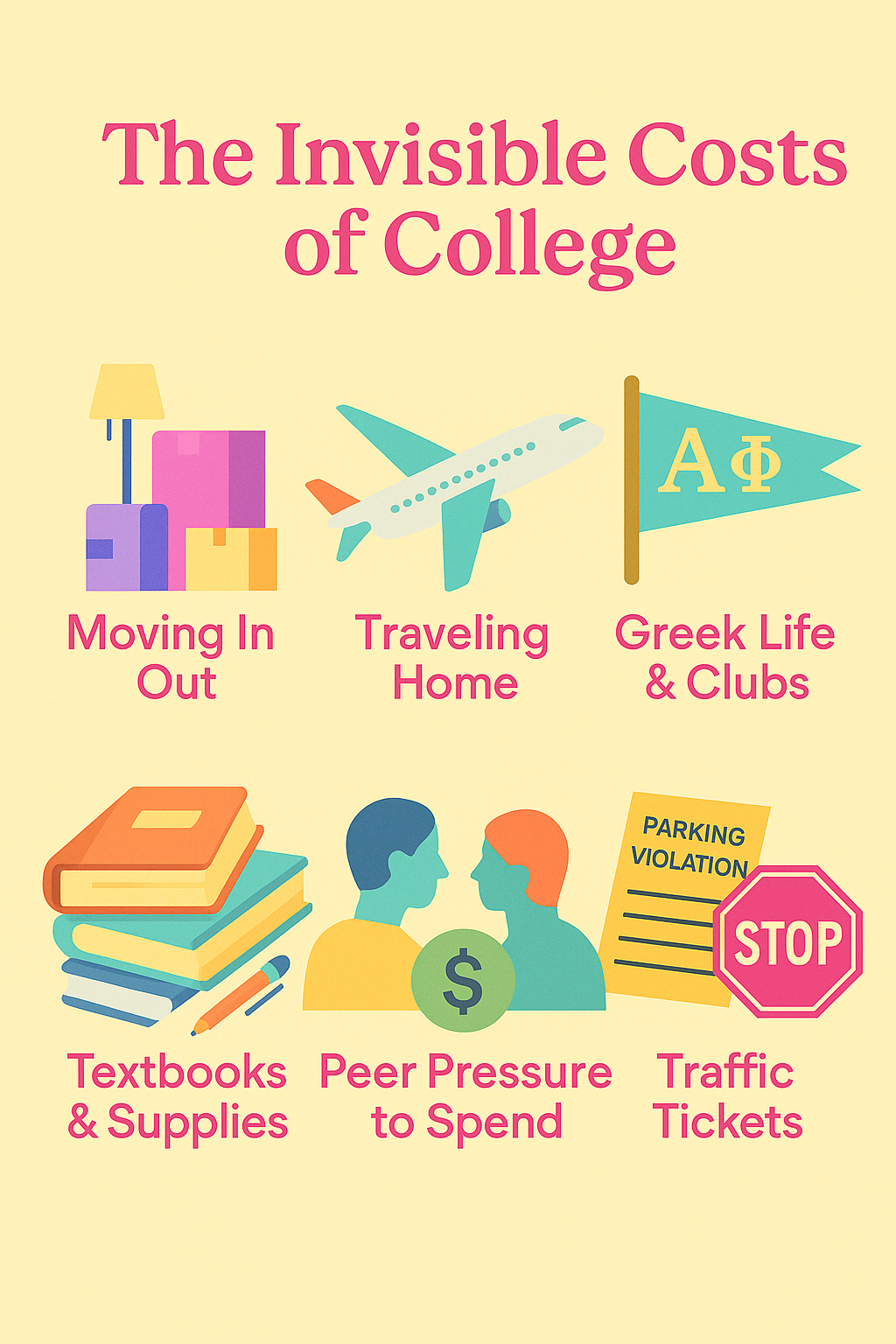

The invisible costs of college

THE INVISIBLE COSTS SERIES RETURNS

It’s Heather, here to welcome you to another edition of The Invisible Costs series, where we examine areas of under-the-radar expenses that sneak up—and add up.

I was recently asked to contribute a piece to a digital magazine on teaching your tweens, teens, and young adult children about money. It left me thinking a lot about all the stuff I knew and didn’t know as I left home for the first time to attend the University of Florida. I knew how to use and manage my debit card, I knew about building credit (conceptually), and I knew how to write a check. I also knew how much my tuition cost. Yay for me, I guess.

My point is, when people talk about the price of higher education, the conversation almost always centers around tuition, room, and board, even though it’s the surprise expenses of living life out in the wild that really catch up to you.

As a new college football season begins (which is basically the lens through which Doug and I view time), I want to shed light on the invisible costs of college. But before you, dearest Gen Z children of the subscribers of this newsletter, roll your eyes at me like I’m some crotchety talking head who’s about to lecture you on the cost of matcha lattes, let me just say: college was the best time of my life. I partied my face off and worked my ass off and experienced three national championships and traveled the world and worked many jobs and joined a sorority and wrote for the city paper and left a better person than the young girl who showed up with a debit card and a dream.

By nature, college is about making some poor choices and being dumb while the stakes are low and luck is hopefully on your side. That being said, I do worry that nowadays, there’s a lot more landmines buried in your everyday financial lives than there were for me. It’s also a hell of a lot easier for you to spend money that you do and don’t have. So, Mom, Dad, reluctant teen readers, let’s take a look around some sketchy corners, shall we?

Moving often. I don’t know anyone who’s lived in the same place for all four years of college, unless they lived at home. Whether you’re moving dorms or apartments, every transition comes with a price tag, from rental trucks, to moving supplies, to new storage solutions for your new space, and possibly storage units if you’re heading home for the summer. Forbes notes that move-in costs are rising faster than tuition, and don’t even get me started on these insane dorm renovations that are flooding my TikTok algo.

Traveling home for holidays and breaks. According to a Kayak report, domestic flight costs are up 3 percent this year. I used to try to maneuver the matrix of Thanksgiving travel by coming home as early as possible, but with testing dates and other commitments, it’s not always possible. There’s a reason flights are so expensive certain weeks of the year: because everyone wants them. If your home is a flight away, you’ve got to assume you’re spending another couple thousand bucks a year to get there.

Going Greek or joining other student organizations. Joining a fraternity, sorority, or other student clubs can be a great way to build community, but they’ll cost you. Greek life dues range from a few hundred to several thousand dollars per semester, depending on the school and whether you’re paying for an in-house meal plan. Beyond those dues, there are also added costs for events, formals, apparel, and fundraisers. Even non-Greek organizations often expect members to chip in for trips, conferences, and swag, which can be tough on students with tighter budgets.

Having FOMO. This one’s hard to quantify, but IYKYK. College is definitely a time for some soul searching, because you’re trying to find your people. Maybe this is your clean slate, or maybe you know what you’ve been looking for and are finally about to get after it. Without the guardrails of having your parents around, it’s incredibly easy to become a yes person and try to assimilate with friends and peers who may not be in the same financial position as you. Pair that with the dangerous BNPL options marketed to young people, and suddenly, you believe you deserve to do things, which in reality, you have no business doing. Not trying to be a buzzkill. Just spitting truth.

Getting traffic and parking tickets. Laugh if you want—this one’s for real! Anyone who’s ever driven at college knows that you basically need to win the lottery or a cage match to obtain permitted on-campus parking. Everyone else is playing a game of campus roulette when it comes to hourly spots, just hoping you’ll make it back to the car in time or that you read the signage properly. At many universities, campus and town police are lying in wait to ding you. Even minor violations can result in $50-100 fines, and that’s child’s play compared to traffic transgressions. My first traffic ticket ever was for rolling through a stop sign in the middle of an empty parking lot. The campus cop drove a motorcycle out from behind a bush to ticket me $350. True story.

Going the extra mile. Beyond the cost of books, which may vary, are additional expenditures that just seem to show up. Even years ago, I would spend extra money every semester on review programs and study materials. I wanted to purchase my own subscription to a specialized design program for my graphic design coursework. This is an outdated example, but I felt like I was always buying expensive resume paper or paying to print out projects (I guess now, you’d liken this to a subscription to Canva pro or something like that). And internships somehow always net negative (on paper!) when you’re buying professional attire for the first time. There are just these items that aren’t required but are something a little less than that. You’ll want them. You’ll need them.

College is expensive enough without being blindsided by expenses no one talks about. By shining a light on the invisible costs—whether they’re Greek life dues, a holiday plane ticket, or the gauntlet of campus parking—students and families can make smarter decisions. The kids will also learn a thing or two about adulting without FAFOing their way into larger money troubles. Then, everyone can focus on the good stuff, like football, friends, and feeling the freedom that comes with this next era of their lives.

Happy tailgate season to all who celebrate. What are some of the invisible costs you remember from college? Any suggestions for our next rendition of The Invisible Costs series? Email us!

Here we are, Gator babies, enjoying some of the best times of our lives. Truly. Being diehard Gators is such a huge part of our story together. We can’t wait to bring the girls to The Swamp as soon as Ruby’s old enough to handle it (I’m thinking next year).

TJA in the news

Doug spoke with NerdWallet about how earning more doesn’t make you immune to credit card debt.

Also, for those with Bloomberg access (sorry!!), he shared some thoughts on there now being more ETFs in the U.S. than individual stocks (wow).

Money Together: have you pre-ordered your copy yet?

Our upcoming book, Money Together: How to find fairness in your relationship and become an unstoppable financial team, arrives on October 28, 2025. If you enjoy The Joint Account, we’d be incredibly grateful if you pre-order from your preferred retailer. Imagine if every one of our subscribers ordered early…that would mean the world to us.

Also…

Are you a financial advisor? Would you like a free chapter of Money Together? Well, we’d love to send you one. All you need to do is e-mail us your request and the name of your firm. It’s that easy!

Shameless plugs

The book site is LIVE! Click here for more info on Money Together and how to have us come chat with your organization!

Also, are you a brand or business interested in reaching The Joint Account’s 14,000+ subscribers?

We’d love to hear from you.

Find us on social: @dougboneparth + @averagejoelle :)

The content shared in The Joint Account does not constitute financial, legal, or any other professional advice. Readers should consult with their respective professionals for specific advice tailored to their situation.

I work at a private university in a student financial office and I always remind students that they have the option to return excess loan funds instead of keeping the refund and accruing the interest.

Now that I know that Sallie Mae is offering up to 17% interest rates on education loans, I’m screaming it from the mountain top.

I wish I enjoyed college this much!